Nominees for Morningstar European Fund Manager of the Year Awards 2012 have been announced, and Adviser Workstation can give you a closer look at the managers, their funds and our Morningstar Analyst Ratings.

The Morningstar European Fund Manager of the Year Awards draw from the expertise of Morningstar’s European fund analyst team and recognise a select number of fund managers in Europe who have demonstrated excellence in the past year and in their stewardship of fund shareholder capital over the long term. The awards are presented in two distinct categories: Fund Manager of the Year: European Equity and Fund Manager of the Year: Global Equity.

The nominees for the Morningstar European Fund Manager of the Year Awards 2012 are:

European Equity:

Fabio Di Giansante, Pioneer Funds Euroland Equity

Charles Montanaro, Montanaro European Smaller Companies

Laurent Dobler and Arnaud Cosserat, Renaissance Europe

Global Equity:

J. Kristoffer, C. Stensrud, Knut Harald Nilsson, Cathrine Gether, and Ross Porter, SKAGEN Kon-Tiki

Andrew Headley and Charles Richardson, Veritas Global Equity Income and Veritas Global Focus

Rajiv Jain, Vontobel Global Value Equity and Vontobel Emerging Markets Equity

Nominations for the awards are made by Morningstar’s European fund research team of 30 analysts located in the United Kingdom, France, Germany, Italy, Spain, The Netherlands, Finland, and Norway. To qualify for a nomination, at least one fund under a fund manager’s leadership must have a qualitative fund rating assigned from Morningstar.

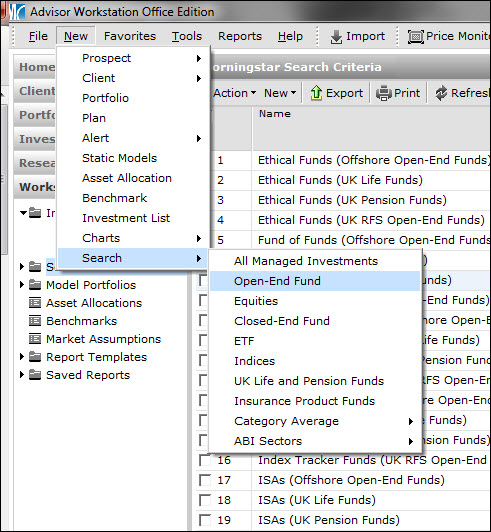

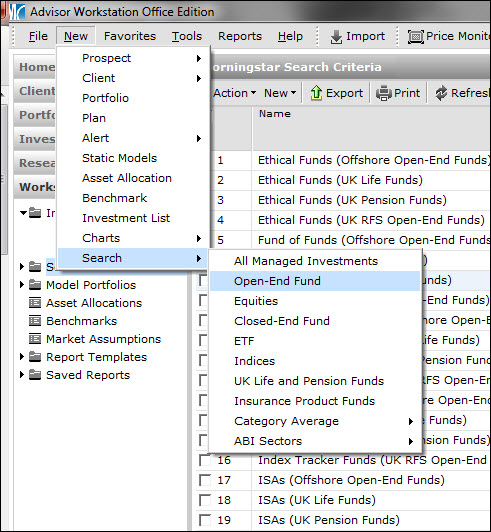

To find the funds in Adviser Workstation, run a search in the Open-End funds universe by going to New>Search>Open-End Fund.

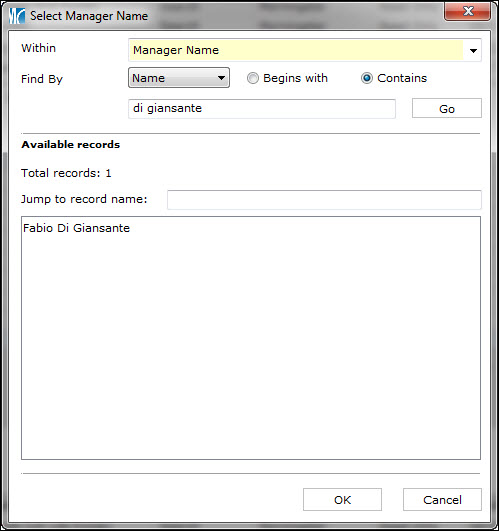

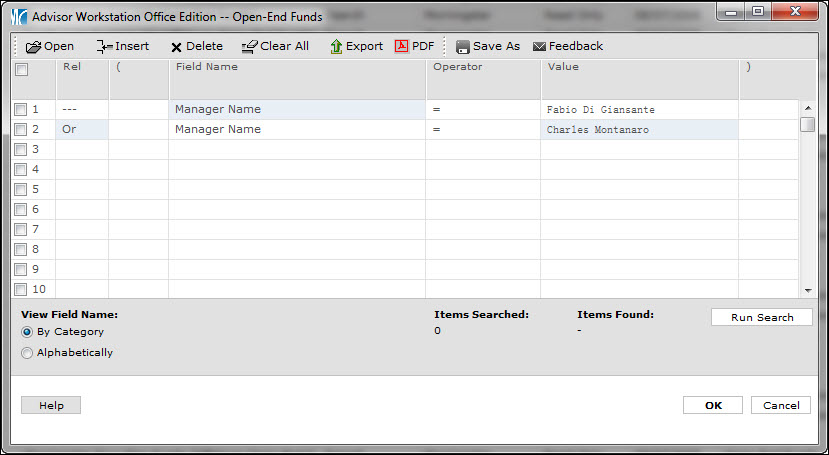

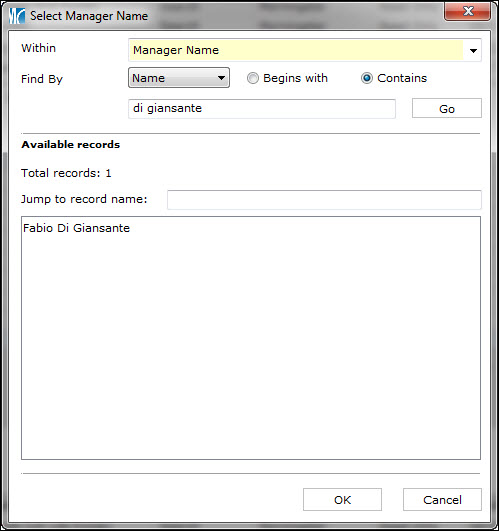

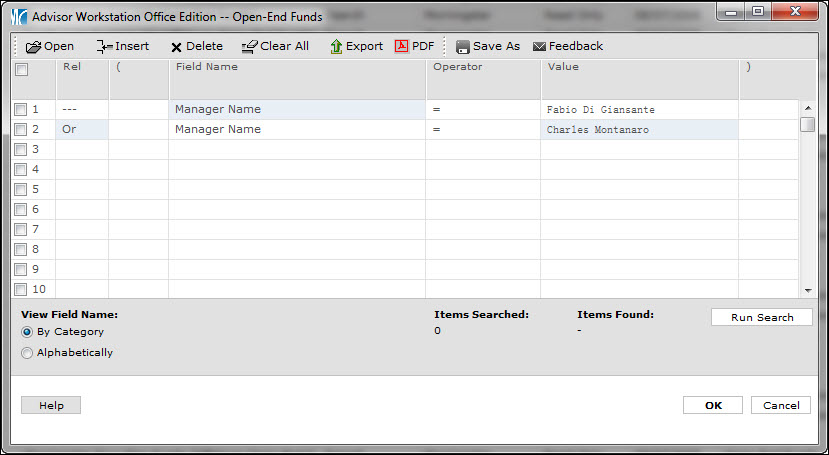

In the first row under Field Name, scroll to find Manager Name, then type in the name and click GO. Once you’ve found the manager, click OK to add the name to the search.

You can add multiple managers at once by using ‘OR’ in each row of the search.

Quick Tip: When typing the name in the Manager Name box, select ‘Contains’ instead of ‘Begins With’ to search first names and surnames.

Visit the post on Analyst ratings to see read more about the managers.

Posted in:

Events,

Morningstar,

Press Releases,

Quick Tips,

Research,