Ethical investing has been on the rise in recent years, though many in the industry have been content to ignore it as a niche market, or one that under-performs compared to it’s ‘sinful’ peers. This is a notion that persists despite strong performance from this sector, and with investors increasingly looking for funds that invest ethically, Morningstar can help provide transparency on a sometimes opaque market. Click below for more information.

Occasionally there’s the need to run a report for more than one client portfolio at a time, and this can be done quickly and easily by creating a portfolio aggregate.

Creating the aggregate portfolio allows you to run all the same charts, reports and analysis that you can do on a standard portfolio, at the aggregate level.

Click the image below for more details.

Morningstar Adviser Workstation provides the option to view detailed information for a portfolio in a single click (as detailed in this post). This shows how you can view the current data or data to the last month end, though it’s also possible to view historical data too using Portfolio Performance reporting.

Click here to see an example of the sort of report available using Portfolio Performance.

If you’d like to see what returns a client’s portfolio had over specific periods, what the up capture ratios were in Q1 last year, or if the securities were in the top quartile in 2013, these and hundreds of other data points are available to include in your report.

Click the folder icon below to find out more.

Morningstar Adviser Workstation contains detailed information on thousands of securities though it’s possible to include securities of your own creation, as well as additional currencies, asset classes and more, and amend the settings on these as necessary.

Definition Master is the tool that provides you the option to amend your security settings. To learn more, please click the icon below for further information:

The Morningstar Client Web Portal makes it easy to quickly and securely share important documents with your clients 24 hours a day, 7 days a week. It can be used as a stand-alone site or the login page can be embedded directly in your firm’s website. Setup is quick and simple, and the Client Web Portal is available as soon as you activate your Adviser Workstation subscription.

The Web Portal also has the option to include detailed portfolio information within each investor’s personal portal. The overview tab proves a summary of current investments, including market values, top 10 holdings, asset allocation, and world regions. Click the graphic below for further details

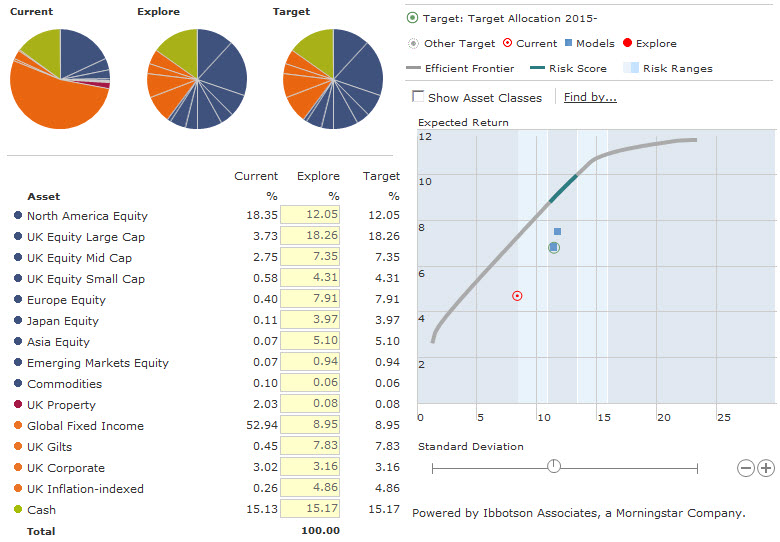

If you have investors approaching retirement, or even already in drawdown, the Investment Planning tool can assist with helping them to plan their finances.

An investment plan clearly presents the current asset allocation, offers the ability to compare this with a recommendation based on the investor’s attitude to risk, and then illustrates graphically the potential outcomes using our Ibbotson market assumptions.

Finally, it is possible to produce a fully customisable report to provide the investor the information they need to make an informed decision.

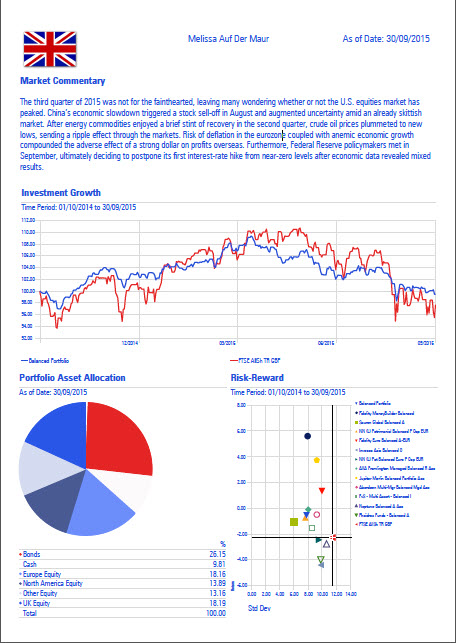

Morningstar Adviser Workstation features dozens of professionally designed reports. However with Report Studio, you can easily create your own custom reports, either as one-off reports for an individual client or report templates for use with your entire practice. In addition to specifying the components of each custom report, Report Studio allows you to incorporate your firm’s logo, custom disclosure information, corporate colour palette, and fonts to create materials that fully align with your firm’s identity and branding.

Click the example report below to visit the Report Studio support page, and see how you can create your own bespoke report today.

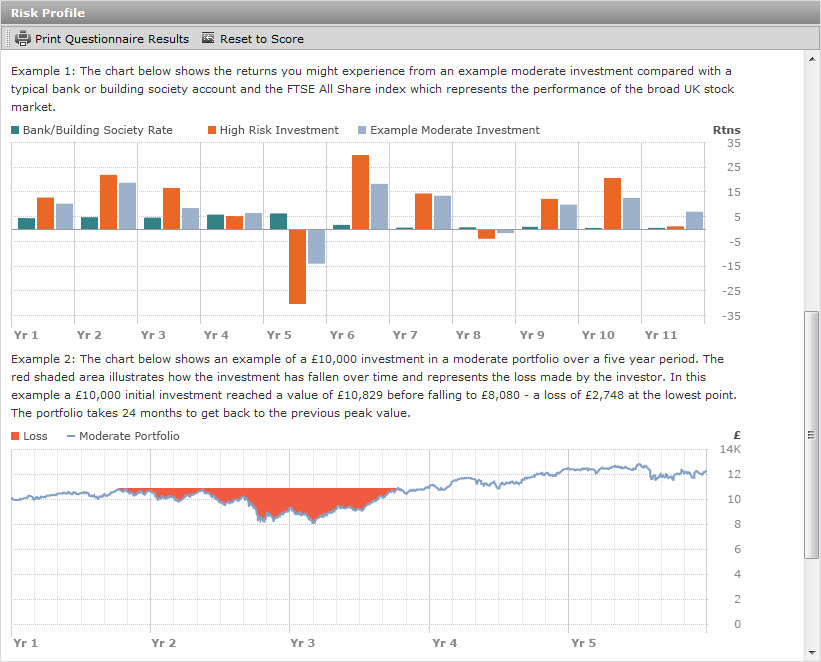

Over the past year, we have taken the feedback from advisers and worked with our consultancy group, asset allocation experts, adviser product and compliance teams to update our Risk Tolerance Questionnaire. In the latest update to Morningstar Adviser Workstation, this questionnaire is now available, with changes including:

- Plain English Campaign Crystal Mark

- Documentation of investment goal

- Quick tips to help investors

- More details around timeframes and how long a client needs access to funds

- Increase in size of investments shown in illustrations

- Risk profile description graphics are more clearly examples and include Max Loss details

The new questionnaire can be found in both the Client Management and Investment Planning modules, while methodology can be accessed in the Training Essentials page

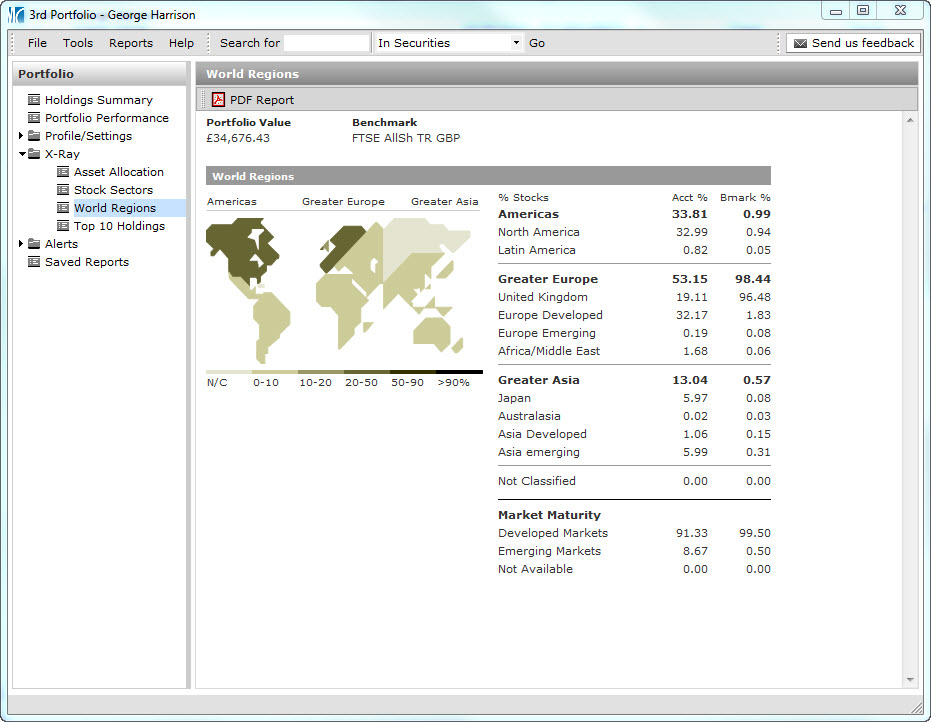

Morningstar Adviser Workstation contains the underlying holdings for thousands of funds, data that can then help with identifying exactly where a client or model portfolio is invested, and hence where changes may need to be made. Adviser Workstation can highlight portfolio weightings on a country or regional basis, by clicking X-Ray > World Regions, or by changing the portfolio view, as illustrated in the link below

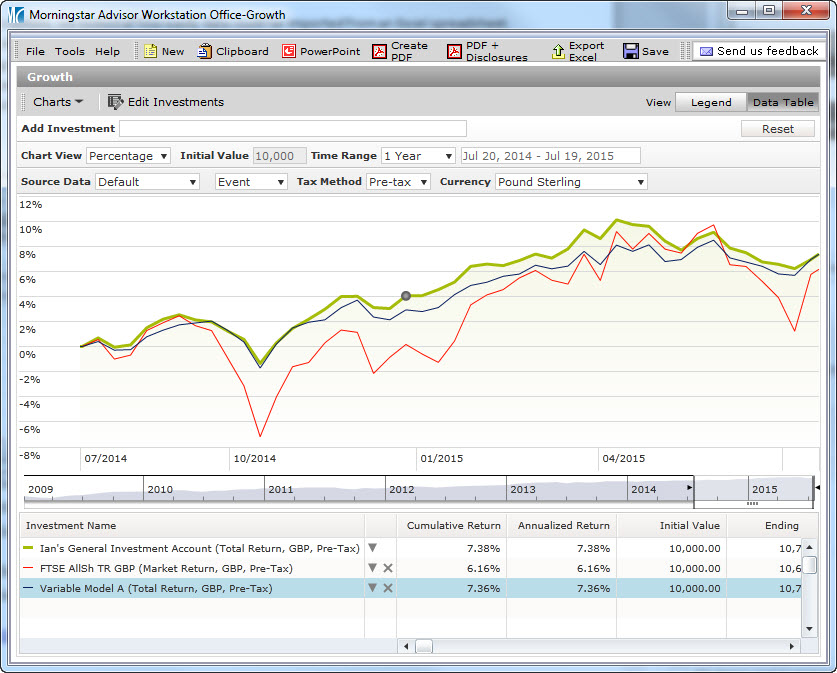

In last month’s update, we looked at how easily data could be imported from an Excel spreadsheet. Now with this data in Adviser Workstation, how can this be analysed? Charting your portfolios and/or holdings can be done in a moment, and can help illustrate to an investor exactly how their securities are performing. Click the link in the chart below to see how make comparisons, which can then be turned into a PDF, PowerPoint slide or copied into a Word document: