I am pleased to confirm the new Risk Tolerance Questionnaire will go live on 16th July 2011.

I am pleased to confirm the new Risk Tolerance Questionnaire will go live on 16th July 2011.

Morningstar’s primary goal and driving force has always been to equip investors and their advisers with accurate, timely and insightful data, research and tools that enable them to make better, more informed investment decisions.

The BBC Panorama programme 13 June 2011 – ‘Can you trust your bank’, in our view highlighted the problem with transactional/sales driven so called ‘advice’. The programme’s focus on poor ‘advice’ through illustrations of individual behaviour within a number of banks highlights the need and value of truly independent advisers, who establish a detailed knowledge of their clients and a long term non-transactional focused relationship.

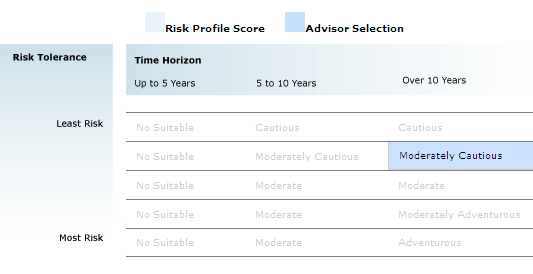

Financial Advisers, powered by Morningstar, can be certain that they are supported by a business that has their client’s investment interests at the forefront. Morningstar provide your business with a scalable robust investment process, one that you can be confident of and your clients happy with. In mid July we will enhance that process with the release of our latest risk profiling tool which has taken into account the FSA’s good practice guidance. It’s important to make clear that tools should provide structure and promote consistency within your business but they are still just an aid to an adviser’s investment process. After all, the client is buying into your advice proposition and the role of Morningstar is to facilitate that.

Our latest RTQ goes further than ever in helping advisers and their clients understand the risk a customer is willing to take as well as their capacity for loss. The Morningstar Risk Profiling Tool, has been created by Ibbotson Associates (part of the Morningstar Investment Consulting business), who are also responsible for creating the asset allocation guidance models.

Clearly, the recent review of wealth management firms, where 14 out 16 firms posed a high or medium-high risk of detriment to their customers, tells us it’s not just the banks that have issues executing best advice practices and underlines the importance of having a robust investment process in place while being supported by a truly independent business partner such as Morningstar.

We here at Morningstar are very proud to announce a strategic partnership with Technical Connection to deliver a gap fill day in September as well as ongoing content and commentary on this blog. Technical Connection are the financial services sector’s pre-eminent supplier of technical insight, support , CPD and proposition development on all aspects of tax, investment, protection, pensions and all aspects of the financial planning process.

We here at Morningstar are very proud to announce a strategic partnership with Technical Connection to deliver a gap fill day in September as well as ongoing content and commentary on this blog. Technical Connection are the financial services sector’s pre-eminent supplier of technical insight, support , CPD and proposition development on all aspects of tax, investment, protection, pensions and all aspects of the financial planning process.

It was fantastic to see so many of you at the conference this year, we sincerely hope you that enjoyed yourself and that you came away feeling energized and full of ideas. If you missed any of the presentations at this year’s conference or just didn’t manage to take notes fast enough, below are links to the slides from each presentation. Videos of many of the presentations will be available soon.

It was fantastic to see so many of you at the conference this year, we sincerely hope you that enjoyed yourself and that you came away feeling energized and full of ideas. If you missed any of the presentations at this year’s conference or just didn’t manage to take notes fast enough, below are links to the slides from each presentation. Videos of many of the presentations will be available soon. Over two days jam-packed with investing passion and expertise, attendees of the Morningstar Investment Conference learned that Schroders’ Richard Buxton is kept awake at night by the sovereign debt crisis (and his two new kittens), heard Old Mutual’s Stewart Cowley compare the US to an “80 times leveraged hedge fund”, and had an opportunity to contrast this with comments from Fidelity’s Trevor Greetham that Obama’s pro-growth stance is the way to go.

Over two days jam-packed with investing passion and expertise, attendees of the Morningstar Investment Conference learned that Schroders’ Richard Buxton is kept awake at night by the sovereign debt crisis (and his two new kittens), heard Old Mutual’s Stewart Cowley compare the US to an “80 times leveraged hedge fund”, and had an opportunity to contrast this with comments from Fidelity’s Trevor Greetham that Obama’s pro-growth stance is the way to go.

Morningstar handed out its annual fund awards last week – congratulations to the winners! A quantitative methodology was used to screen for the top 10 funds in each category then our analysts chose the winners. Without further ado the winners are listed below:

Morningstar handed out its annual fund awards last week – congratulations to the winners! A quantitative methodology was used to screen for the top 10 funds in each category then our analysts chose the winners. Without further ado the winners are listed below: Today, March 3rd, 2011 Morningstar will be presenting its 2011 fund awards to fund managers and representatives of fund houses that have exhibited exceptional value to investors over the last 12 months. Morningstar is of course not alone in handing out fund awards so I thought it might be useful to examine what fund awards really mean.

Today, March 3rd, 2011 Morningstar will be presenting its 2011 fund awards to fund managers and representatives of fund houses that have exhibited exceptional value to investors over the last 12 months. Morningstar is of course not alone in handing out fund awards so I thought it might be useful to examine what fund awards really mean. It’s been nearly a month since my last post and I’m just about settled into 2011, ready for another year of evolution. I think new year’s resolutions are a joke but if I had to have one it would be for our Friday afternoon 5-a-side team to break the .500 barrier this year! Not setting my sights very high I know but you haven’t seen us play…

It’s been nearly a month since my last post and I’m just about settled into 2011, ready for another year of evolution. I think new year’s resolutions are a joke but if I had to have one it would be for our Friday afternoon 5-a-side team to break the .500 barrier this year! Not setting my sights very high I know but you haven’t seen us play…