We here at Morningstar are very proud to announce a strategic partnership with Technical Connection to deliver a gap fill day in September as well as ongoing content and commentary on this blog. Technical Connection are the financial services sector’s pre-eminent supplier of technical insight, support , CPD and proposition development on all aspects of tax, investment, protection, pensions and all aspects of the financial planning process.

We here at Morningstar are very proud to announce a strategic partnership with Technical Connection to deliver a gap fill day in September as well as ongoing content and commentary on this blog. Technical Connection are the financial services sector’s pre-eminent supplier of technical insight, support , CPD and proposition development on all aspects of tax, investment, protection, pensions and all aspects of the financial planning process.

Technical Connection is based in Staple Inn, London and is led by Tony Wickenden and John Woolley.

You can find more about their products and services, including a free trial of Techlink Professional, technical connections knowledge management, research, business generation, client communication and CPD plaftorm here: www.technicalconnection.co.uk and www.techlink.co.uk

Below is a brief sample of some of the content you’ll find on the Techlink website:

DWP Consults On Regulations To Permit Reduction Of Pension Benefits Where Scheme Meets Member’s Annual Allowance Charge

SYNOPSIS: The DWP is consulting on amending regulations which are designed to enable a member’s scheme benefits to be reduced where he has elected for his scheme to meet all or part of his annual allowance tax charge.

The Government has confirmed that it will permit pension scheme members subject to an annual allowance charge of more than £2,000 to elect for all or part of that charge to be paid by their scheme with their benefits being appropriately reduced to allow for this. Legislation to enable this has been included in Schedule 17 to the Finance (No.3) Bill 2011. However, Section 91 of the P..continued on the Techlink website

RLP Savings __

SYNOPSIS: The tax benefits of an RLP make it a “no brainer” for employee life cover

The following example illustrates the significant savings that can be secured through the provision of life cover for an employee through a Relevant Life Policy. Provided all the conditions are fulfilled (including the absence of a tax avoidance motive) there is no statutory limit on the level of cover/premium. In the example, comparing the cost of providing the same life cover through a..continued on the Techlink website

France To Introduce Property Tax For Foreign Owners __

SYNOPSIS: France to introduce a 20% tax on rental value on holiday homes.

The French Government has approved a new tax on non-resident property owners which would affect British people who own homes in France. The tax will be debated in the French parliament in July and if enacted will come into effect next year. The tax will be set at 20% of a property’s nominal rental value and is being seen as a second owner levied tax on top of the current taxe fonciere (levi..continued on the Techlink website

Discounted Values Under Discounted Gift Trusts __

SYNOPSIS: The recent decision in the sex equality case of Test-Achats raises questions as to whether the current method of valuing the income rights under Discounted Gift Trusts needs to be revised. HM Revenue and Customs has now made a statement on this.

The Discounted Gift Trust (DGT) enables an investor to invest a cash sum in a single premium bond that is held subject to a special trust that gives ‘income’ rights to the settler whilst alive and death benefits to a trust – typically a discretionary trust…continued on the Techlink website

Technical Connection

020 74051600

Derek.Lovell@technicalconnection.co.uk

Clare.Thomas@technical connection.co.uk

The gap fill day is scheduled for September 14th in London. For further details please call 0203 107 0040 or email events.rsvp@morningstar.com.

Posted in:

Events,

Morningstar,

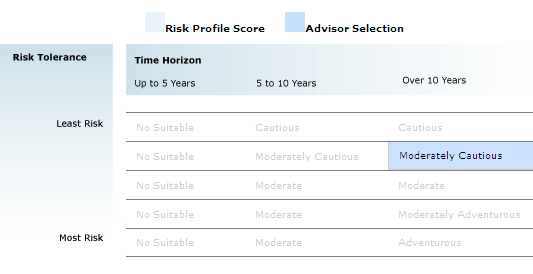

I am pleased to confirm the new Risk Tolerance Questionnaire will go live on 16th July 2011.

I am pleased to confirm the new Risk Tolerance Questionnaire will go live on 16th July 2011. We here at Morningstar are very proud to announce a strategic partnership with Technical Connection to deliver a gap fill day in September as well as ongoing content and commentary on this blog. Technical Connection are the financial services sector’s pre-eminent supplier of technical insight, support , CPD and proposition development on all aspects of tax, investment, protection, pensions and all aspects of the financial planning process.

We here at Morningstar are very proud to announce a strategic partnership with Technical Connection to deliver a gap fill day in September as well as ongoing content and commentary on this blog. Technical Connection are the financial services sector’s pre-eminent supplier of technical insight, support , CPD and proposition development on all aspects of tax, investment, protection, pensions and all aspects of the financial planning process. The details of the UK’s first quarter economic performance were released last week and I was surprised that the figures received relatively little coverage given their shock value.

The details of the UK’s first quarter economic performance were released last week and I was surprised that the figures received relatively little coverage given their shock value.

It was fantastic to see so many of you at the conference this year, we sincerely hope you that enjoyed yourself and that you came away feeling energized and full of ideas. If you missed any of the presentations at this year’s conference or just didn’t manage to take notes fast enough, below are links to the slides from each presentation. Videos of many of the presentations will be available soon.

It was fantastic to see so many of you at the conference this year, we sincerely hope you that enjoyed yourself and that you came away feeling energized and full of ideas. If you missed any of the presentations at this year’s conference or just didn’t manage to take notes fast enough, below are links to the slides from each presentation. Videos of many of the presentations will be available soon. Over two days jam-packed with investing passion and expertise, attendees of the Morningstar Investment Conference learned that Schroders’ Richard Buxton is kept awake at night by the sovereign debt crisis (and his two new kittens), heard Old Mutual’s Stewart Cowley compare the US to an “80 times leveraged hedge fund”, and had an opportunity to contrast this with comments from Fidelity’s Trevor Greetham that Obama’s pro-growth stance is the way to go.

Over two days jam-packed with investing passion and expertise, attendees of the Morningstar Investment Conference learned that Schroders’ Richard Buxton is kept awake at night by the sovereign debt crisis (and his two new kittens), heard Old Mutual’s Stewart Cowley compare the US to an “80 times leveraged hedge fund”, and had an opportunity to contrast this with comments from Fidelity’s Trevor Greetham that Obama’s pro-growth stance is the way to go.